Leverage

your

past,

not

your

future...

About

Us

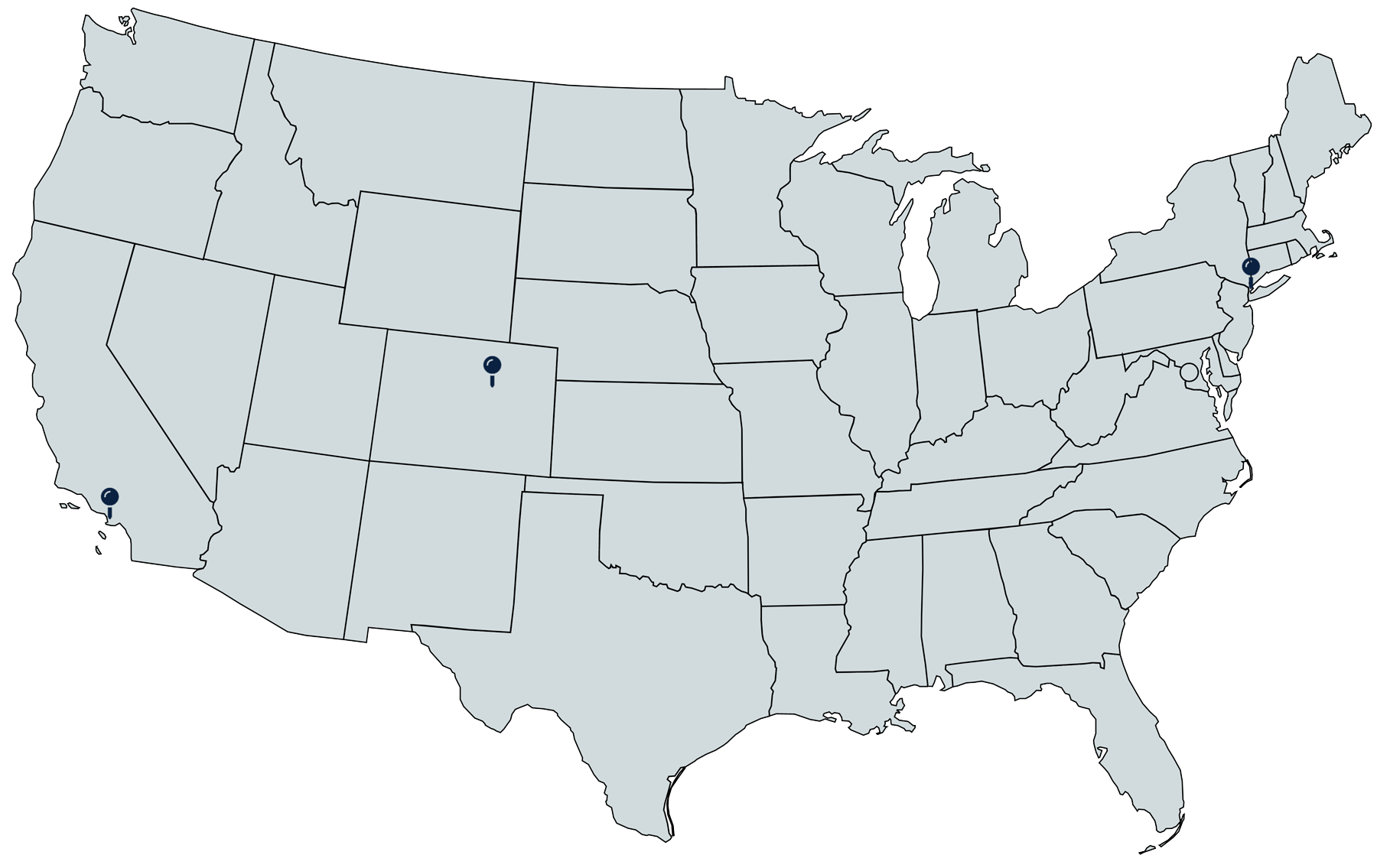

Luxury Asset Capital® is the leading provider of confidential non-bank loans that use borrowers’ luxury assets as collateral. The company serves clients through its highly trusted brands including Borro, Beverly Loan Company, and New York Loan Company, providing short-term loans that fund in 1-2 business days using a borrower’s luxury asset(s) as collateral.

Our brands have loaned over one billion dollars to tens of thousands of clients across

the country making Luxury Asset Capital the nation’s largest privately-held provider of non-bank loans that use borrowers’

luxury assets as collateral.

OUR BRANDS

Our Lending Process

OUR TEAM

Dewey Burke

Founder & CEO

Brian Cornick

Chief Financial Officer

Katelyn Conlon

Chief Revenue Officer

Eva Quiroz

Chief Compliance Officer

Richard Shults

Chief Valuation Officer

GIA Graduate Gemologist

Caitlin St John

Senior Vice President of Operations

Head of New York Office

Chloe Kilburn, M.A.

Senior Vice President of Fine Art

Bruce Singer

President, Car Division

Mitzy Colledge

Senior Director of Client Management

Kim Mrvos

Senior Director of Client Engagement

Conner Cole, GG

Senior Director of Client Engagement

Head of Luxury/Collector Car Division

Deah Jones, GD (GIA)

Director of Client Management

Katie Chamberlain

Senior Director, Head of BH Office

GIA Graduate Gemologist

Brad Powell, GD (GIA)

Senior Director of Valuation

Becky McDonnell, GD (GIA)

Senior Director of Client Engagement

Jennifer Brown

Director of Client Engagement

Lizzie Franco

Director of Fine Art

Ryan Laurence

Director of Client Management

Israel Narvaez

Director of Client Engagement

Rita Azaryan

Associate of Client Engagement

GIA Accredited Jewelry Professional

Jeneba Jabbie

Associate Of Client Engagement

GIA Graduate Gemologist

GIA Jewelry Design

Laura Serrano

Senior Director of Accounting

NEWS

Fox Business Network Interview with Luxury Asset Financing Expert Dewey Burke

Buy, Sell, Hold: Spotlight #49 – Katelyn Conlon – Chief Revenue Officer at Luxury Asset Capital

Luxury Asset Capital Establishes Luxury and Collector Car Division in Beverly Hills

Luxury Asset Capital Announces Two Strategic Acquisitions

The Business of Collateralizing Luxury Goods

20 Minutes With: Dewey Burke, Founder & CEO of Luxury Asset Capital

5 Things Every CEO Should Know About Navigating The World Of Finance

Luxury Asset Capital and Vintage Motor Management Partner

Luxury Asset Capital Acquires and Relaunches Borro

Luxury Asset Capital Acquires and Re-Launches Borro Private Finance

WatchBox And Luxury Asset Capital Let You Borrow Against Your Best Watch

Luxury Asset Capital Announces Key Initiatives to Accelerate Growth

CONTACT US

Call, email, or visit us today!

Beverly Hills

9440 S. Santa Monica BoulevardSuite 101

Beverly Hills, CA 90210

310.275.2555

bh@luxuryassetcapital.com